Bitcoin, Bridging Hearts and Minds: A Network Reconnecting Humanity with Its True Nature

Bitcoin is the technology that unifies our material reality with nature, our logic-minds with our heart-minds, a tool for humanity to ascend to a higher consciousness.

Bitcoin, in its 15th year of existence, has now gone mainstream. With the approval of Bitcoin exchange-traded funds (ETFs), making it easier for investors to gain exposure to Bitcoin, waves of institutional adoption in recent years solidified Bitcoin as digital gold.

As the price of Bitcoin increases, corporations allocate capital to stockpile Bitcoin. Nation-states have also entered the race accumulating Bitcoin. With US adoption of a Bitcoin Strategic Reserve, other nations are eager to add Bitcoin to their reserve assets.

The prospect of Bitcoin becoming a global reserve asset is now being celebrated. Some see this trend as a path toward hyperbitcoinization, defined as “the inflection point at which Bitcoin becomes the default value system of the world”.

What does it mean for Bitcoin to become a standard for our value system? What does a hyperbitcoinized world look like? It seems that things are moving in a direction for this to mean the standardization of corporate Bitcoin treasury strategy.

While global firms’ drive for accumulation pushes up Bitcoin’s market cap, Bitcoin is more than just the digital asset that the company holds on the balance sheet. It possesses values that cannot be solely measured by price.

Here, I argue that the significance of this technology lies in its power to transform our way of thinking and being in the world. To explore this, let’s first look at how Bitcoin came about.

Response to a moral crisis

Bitcoin was born in the aftermath of the global financial crisis. Triggered by the collapse of the US housing market and the failure of financial institutions, the panic of ‘08 has revealed a particular mentality that has been a driving force behind the Western civilization.

Embodied in the ideology of infinite economic consumption and a corporate doctrine of profits at any cost, it is a mode of thinking that views the world materialistically and seeks for constant expansion. This mindset has permeated our society and has turned the economy into a speculative casino.1

Too big to fail banks becoming a vehicle for man’s unbridled greed gambled carelessly with taxpayers money. The act of speculating that spread widely became uncontrollable. This has led to moral corruption of our institutions.

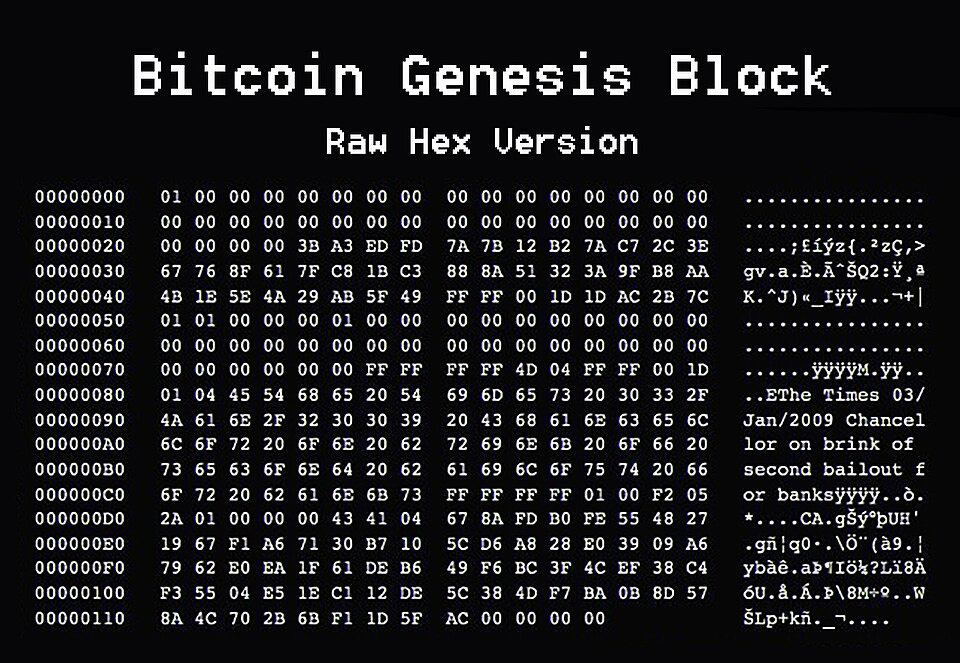

After the financial meltdown, those who were responsible for wrecking our economy never faced consequences. With a bank bailout and a cycle of austerity, they were able to get away with their fraud and recklessness. Bitcoin was invented as a response to this moral crisis.

Speculative madness

What is the mind that has created this speculative madness? A Swiss psychiatrist, Carl Jung, became aware of this internal condition, when he traveled to the US and saw its culture through the eyes of Native Americans.

In his autobiography, Jung (1961/1989) recollected his encounter with the Pueblo Indians in his visit to New Mexico. There he met a chief of the Taos Pueblos, named Ochwiay Biano. Biano shared with Jung his observation of white men saying how “the whites always want something; they are always uneasy and restless and that we think that they are mad” (p. 248).

When Jung further asked him why he thought white men are mad, Biano said how “they say they think with their heads” and he noted that he and his people think with their hearts. This response surprised Jung, because he believed that thinking takes place in the head.

Thinking with the heart allows us to have a sacred connection to Mother Earth, the ground beneath us that supports all of our existence. It reminds us that we are parts of an interdependent web of life.

With this capacity to think with the heart, indigenous people understood the impact of their actions on all living beings. They had a vision to see seven future generations after us, their faces peeking through a cloud and they made decisions with consideration for those yet to come.

Our industrialized society has moved us away from connecting to this heart-based knowing. As was pointed out by the Hopi elder, we modern people begin to think with our heads.

Economic man

A head-based thinking generates a sense of self that is separated from others. Being cut off from the heart, we begin to see reality in its isolation. Our vision becomes narrow and short-sighted. In our highly consumerized culture, we are made to seek for instant gratification and act without concern for the effect of one’s actions upon the environment and others.

This state of personhood can be characterized as "Homo economicus," or "economic man," a hypothetical model of figure used in economics. The term describes an individual who acts purely rationally and seeks to maximize their utility. 2

Rational economic man, being uprooted from the heart, can act overly selfish. Instead of working with negotiations and diplomacy to achieve optimal outcome for all involved, head -centric individuals refuse to cooperate. The extremity of this mentality leads to a zero-sum thinking, namely “you win or you lose”. This mindset believes one can only gain at the expense of the other party and that mutual gain is not possible.

Logic of conquest dictates the zero-sum game. Thinking with heads, not being tempered by a life of feeling, sees no boundary. It can only serve the animalistic parts of us and makes us act ruthlessly without any regard to the welfare of others. 3

We have seen how this logic has taken over our economic system. From commodity trading to real estate, investors, who act like gamblers, chase after emerging markets to make a killing. Rapacious speculators use financial trickery to suck the lifeblood from an economy, leaving destruction and destitution in its wake. Using free money injected through central banks, they can keep this merciless game indefinitely.

As this zero-sum way of thinking is leading us to our own destruction, a breakthrough of computer science brought a creative way to tackle this unruly mind.

Innovative incentive structures

Bitcoin brings a new competing system with a win-win incentive structure, where cooperation leads to mutual benefits. At the heart of Bitcoin is mining. It is a broadcast guessing game engaged by specialized computers accessible anywhere in the world. It sustains the life of Bitcoin.

The process verifies transactions, maintains the integrity of the network and builds the chain forward. On average every 10 minutes there is a winner that is rewarded with new currency issuance. This elegant system is built using the knowledge of game theory.

Game theory is a mathematical framework analyzing strategic interactions between individuals. Its behavioral model is based on an assumption of economic rationality. The Rational Actor Theory posits that people act according to self-interest, making decisions that maximize their own payoff and minimize their costs based on the information available to them.

With this assumption of economic incentives that shape behavior, Satoshi Nakamoto, the pseudonymous creator of Bitcoin, was able to meet the mind of an economic man and designed a new secure monetary system.

The Nash equilibrium

Now, let’s look at how this plays out in the Bitcoin network. In life situations, there are various motives that come into play to influence how we act, but in Bitcoin mining, players are expected to be driven purely out of economic self interest. Miners are greedy. By expending resources they are playing to win the game and maximize their profits, unconcerned about the loss of others.

The questions then arise; When everyone pursues and maximizes their self interests, how is it possible to ensure that the entire system isn’t corrupted or destroyed as we can see with the fiat system? How does Bitcoin enforce rules and maintain its integrity?

Here, the Nash equilibrium, the fundamental concept within game theory, played a vital role in solidifying Bitcoin's noble architecture. 4 5

The Nash equilibrium was developed by American mathematician John Nash. It is a theory about strategic decision making processes within non-cooperative situations. 6 The Nash equilibrium describes a scenario where, in a game involving multiple players, each participant arrives at a decision that is optimal, when considering the decision of other players.

The significance of the Nash Equilibrium is that it creates a nonzero-sum outcome in a non-cooperative situation. Everyone wins, because everyone gets the outcome that they desire.

The environment that miners are engaged in is non-cooperative. Indeed, Bitcoin mining is brutally competitive. Yet at the same time, the game produces the outcome that sustains the network and maximizes rewards for all its participants.

Appealing to self interests

So, how does the Nash equilibrium, as a cornerstone of Bitcoin, make this possible? With the Nash theorem, players do not have to compromise, and they achieve the optimal outcome by not deviating from their initial strategy.

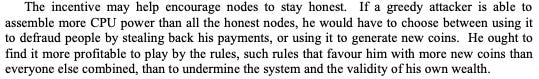

Bitcoin through the method of decentralization allows everyone to act freely out of self interests, being honest with what they want. With clear rules and transparency, incentives are designed in a way that speaks to the rational mind. 7

Economic men, with their thinking head, cannot think of the common good. They are not wired to see beyond their narrow self interests. Economically rational actors have no interest in understanding the perspectives of others, unless doing so benefits them.

By setting the game so that their optimum outcome will be delivered by taking others’ strategies into account, it makes economically rational individuals determine their best payoff in the context of a whole with the decision of other players involved.

Concretely, in the mining competition, all players act out of self-interest. Yet, the reward for playing by the rules is higher than potential gains one may achieve by attacking the network, so each participant is incentivized to uphold the rules of the network and not to unduly benefit off of the altruism of everyone else.

Here, what is important to understand is that the genius of Bitcoin’s incentive structure makes taking consideration for the welfare of the network a rational decision. Thus, economically rational individuals are given a choice to come to their own independent decision to follow rules, without external coercion.

The laws of peace

Through Nash’s beautiful mind8, the intelligence of the heart revealed itself. Heart looks after everyone’s well-being. Acting as a neutral arbiter, it allows all to pursue their self interests. At the same time, it balances the opposing forces to create an equilibrium—a state in which everyone’s self interests align.

This working of a new mind of the heart is recognized as a law. In a video of Game Theory 101, William Spaniel characterizes “Nash equilibrium" as “a law that no one wants to break even in the absence of an effective police force.”

It is a law that establishes harmony upon the principles of consensus; that premises that no one should be made to act against their will (freedom).9 This is a law of peace, the governing principle of the universe.

Indigenous people of North America, through their thinking with the heart, lived in a way that honors this cosmic law. Hopi, whose name means “one’s heart is at peace” (Kaiser, 1991, p. 78), practiced consensus-based decision making. Also, other Native Americans like Iroquois established its Confederacy with the Great Law of peace, which is the oldest living participatory democracy on earth.

The principle of peace that guarantees everyone’s freedom, while simultaneously establishing harmony, was the highest law of the land that has existed before the dawn of the nation-state, prior to men creating the legal laws.

This supreme law of nature was transmitted orally and through wampum belts, which were regarded as one of the earliest forms of money. It is this wisdom that inspired the Founding Fathers of the United States in the development of the U.S. Constitution. 10

The Natural State

Underneath the construct of nation-state governance, there is an intelligent network of society. It is a province of nature – the Natural State.11 As modernity began to shape our civilization, our thinking became separated from the heart. We have left this harmonious world behind and begin to experience conflicts and suffering.

Yet, this separation from the heart was necessary. It gave freedom for each of us to develop our own distinct sense of self. If our thinking remains connected to the heart, we exist as a part of the whole and can’t recognize ourselves as unique individuals.

Led by the impulse for individual freedom, Western civilization has taken a path of external development in the physical world. With materialistic scientific knowledge and advancement of technology, it has diverged from the civilization of indigenous people who have lived in balance with nature.

Now, with the rise of Bitcoin, perhaps we are seeing a new light that is cast from our forgotten past, illuminating our way toward a new future. One by one, those who fell into the Bitcoin rabbit hole begin to re-discover our connection to the kingdom of nature. The illusion of mind makes us feel separate from this foundation of life, yet whether we know it or not, we all living beings are always under her jurisdiction.

New enlightenment

Now individuals, out of their own freedom are choosing to enter into a network bound by laws of nature. Like after a long sojourn coming home, many of us are now returning to this world that we have left behind—an unfamiliar yet familiar place at the same time.

There, we reunite with our ancestors, who have walked the path of the sacred heart. With gifts of technology and scientific knowledge, we can now join the circle of our founding mothers of democracy.12

Hyperbitcoinization is a state where wisdom inherent in Bitcoin incentives reaches across the globe, awakening our hearts. This ushers in a new enlightenment, opening the possibility for two separate civilizations to come together. The Great Law of Peace gave wisdom for Native people to solve conflicts among tribes and attain peace. Now, with Bitcoin, we can achieve agreements between sovereign individuals and unite as one humanity to scale peace at a wider level.

Now, the heart of Bitcoin that beats every 10 minutes begins to synchronize with the heartbeat of Mother Earth. It inspires us to think in a new way.

Modernity pulled society deep into the density of material, Bitcoin is the technology that unifies our material reality with nature, our logic-minds with our heart-minds, a tool for humanity to ascend to a higher consciousness.

Hyperbitcoinization has just begun. We are adopting Bitcoin. Block by block, together, we build a new civilization, making the way of peace become the standard for our new world.

References:

Jung, C. G. (1989). Memories, dreams, reflections (A. Jaffe, Ed.) (R. Winston, C. Winston, Trans.) (Rev. ed.). New York, NY: Vintage Books. (Original work published 1961).

Kaiser, R. (1991). The voice of the great spirit: Prophecies of the Hopi Indians. MA: Shambhala.

Nakamoto, S. (n.d.). Bitcoin: A peer-to-peer electronic cash system. Bitcoin.org. Retrieved from https://bitcoin.org/bitcoin.pdf

Wallace, P. (1994). The iroquois book of life: White roots of peace. Santa Fe, New Mexico: Clear Light Publishers.

Acknowledgements:

I would like to thank Andoni Nicolau for his valuable feedback and proofreading.

Footnotes:

With deregulation such as repeal of the Glass-Steagall Act in 1999 that had separated commercial banking and investment banking, over the years, the financial system has been restructured to incentivize speculation. Financial instruments like derivatives (to create money and ways to derive more wealth) are used to turn what was a real economy into a huge Wall Street casino.

There is nothing wrong with individuals calculating their gain and acting out of self interests. We all do and indeed it is imperative that we do look after ourselves. The issue arises when this has become a sole motive for our actions, and the system is built in a way that no other forces are allowed to enter to balance it.

This game ruled by might was played out historically. As a dark side of the Western civilization, we have seen it in European colonists’ dispossession of indigenous lands in North America, where gains were made at the expense of suffering of natives.

This land grab type of one-sided game that has led to the tragedy of commons continued on in the modern economy. Instead of outright use of violence with guns and cannons, warfare was carried out through finance being used as instruments for the material accumulation and conquest of territory.

In the 1950’s, game theory was further developed by American mathematician John Nash. In his 1951 article "Non-Cooperative Games", Nash defined the Nash equilibrium. This has been considered to be one of the most important concepts for solving all games and a fundamental practice of game theory. Nash received the Nobel Prize in economics for his contribution to game theory.

Several individuals have noted the strong influence of Nash’s work on Bitcoin. See Jon Gulson’s work here.

In the book “Bitcoin and Nash equilibrium: The emerging Bitcoin equilibrium”, Bryan Solstin, who has explored the life and work of this mathematical genius, points out Nash’s idea of “asymptotically ideal money," as an immortal equilibrium, immune to political manipulation. He argues how it matches with Bitcoin’s design.

In the interview on Robert Breedlove’s “What Is Money” podcast (episode 528), Solstice mentioned that Nash, during a period of mental instability, believed himself to be the “Prince of Peace”.

When we look at the premise of Nash Equilibrium that enables non-cooperative behavior to become cooperative, it can be applied to improve international relationships.

There are games that rely on altruistic motivations (altruistic behavior of the players in non-cooperative game theory). It requires collective decisions that seek for the best interest of the other players. Unlike those programs, the Nash model regards all games as non-cooperative. It assumes economic rationality, meaning that individuals are driven by self interests and act to maximize their expected utility.

Rules include the total number of bitcoin created, a predictable issuance rate and automatic adjustment of mining difficulty.

John Nash became well known to the general public for the Hollywood movie, “A Beautiful Mind”, which was a biographical interpretation of his life.

David Graeber pointed out how initiators of consensus “saw consensus as a set of principles, a commitment to making decisions in the spirit of problem-solving, mutual respect, and above all, a refusal of coercion”.

He clarified how it is “not a set of rules,” but is “a set of principles”. Graeber described its underlying ethics: “all voices have equal weight, that no one be compelled to act against their will.” He characterizes it as a principle of equality and freedom in which “everyone should have equal say (call this ‘equality’) and nobody should be compelled to do anything they really don't want to (call this, ‘freedom’)”. He called it “a way to find consensus” and that “it’s not itself ‘consensus’ ”. He described how this form of decision-making was practiced in indigenous societies in America and also in many parts of Africa.

The orthodox knowledge traces democracy from ancient Athens to the European Enlightenment. Yet, alternative views are emerging that indicate the origin of the enlightenment goes much deeper rooted in North America before the settlement of English colonies.

In "The Dawn of Everything: A New History of Humanity”, David Graeber and David Wengrow argue how Native Americans, particularly the Huron-Wendat statesman Kandiaronk, his critique of Europe, have influenced European enlightenment thinkers.

Native Americans lived with abundance of natural resources and beauty long before the arrival of European settlers.

With the union of mind and heart, each of us can come to recognize the value of this precious planet that we cannot put a price tag on. Bitcoin allows us to share this common wealth and all of us to prosper. The ideas of individual liberty, marketplace and private property come to flourish in a way that honors the commons, and the values of sharing and gifting.

As usual, another truly thought provoking article from this gifted author. I mean, what other writer would have you finishing a bitcoin-related article imagining how the mining of a block every 10 minutes is sort of like the sounding of a deep bass native drum, going wump wump, every 10 minutes, all across the surface of the Earth. Like the Earth's heart itself speaking. This is, without a doubt consciousness raising stuff, and it's exciting to think that, despite all of mankind's foibles, this new era is close at hand. Once firmly within this new age, it'll be enough to make us go, 'what in God's name were we thinking', when looking back to the present day. Truly amazing how a technology of the modern tech age----computer science----gave us a tool to reconnect us to our primal heart-centered essence. Way cool.

Written by your Heart, message received. No further words from this reader, only a smile. Thank you again.